As a mortgage broker in Saskatoon, I understand how difficult it can be for clients with bad credit to secure a mortgage. However, it’s not impossible, and I’m here to help. In this blog post, I’ll provide you with some tips and advice on how to obtain a mortgage with bad credit in Saskatoon.

Understand your credit score

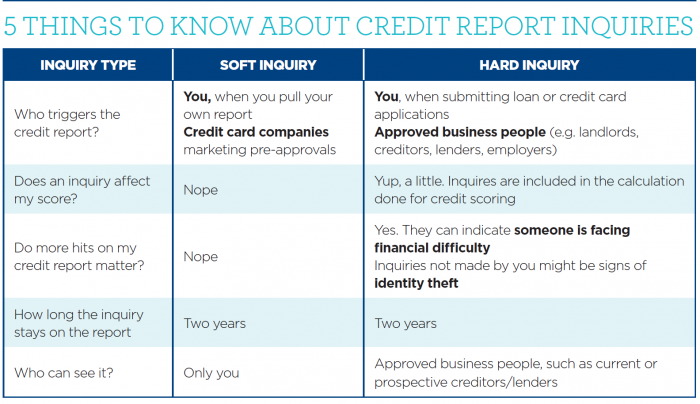

The first step in obtaining a mortgage with bad credit is to understand your credit score. Your credit score is a three-digit number that ranges from 300 to 900 and is calculated based on your credit history. A score below 600 is considered bad credit, and lenders may be hesitant to approve a mortgage.

If your credit score is below 600, you should take steps to improve it. This can include paying off outstanding debts, making your payments on time, and reducing your credit utilization ratio. Improving your credit score can help you qualify for better interest rates and lower fees.

Consider a co-signer

A co-signer is someone who agrees to be responsible for the mortgage if you default on your payments. A co-signer with good credit can help you qualify for a mortgage even if you have bad credit. However, it’s important to choose a co-signer who has a good credit history and is financially stable.

Save for a larger down payment

If you have bad credit, you may need to put down a larger down payment to qualify for a mortgage. Typically, lenders require a down payment of at least 5% to 20% of the home’s purchase price. However, if you have bad credit, you may need to put down a larger down payment to offset the risk to the lender.

Saving for a larger down payment can also help you lower your monthly mortgage payments and reduce the amount of interest you’ll pay over the life of the loan. Consider setting up a separate savings account for your down payment and make regular contributions to it.

Work with a mortgage broker

Working with a mortgage broker can help you find a lender who is willing to offer you a mortgage despite your bad credit. Mortgage brokers have access to a variety of lenders and can help you find the best mortgage rates and terms.

A mortgage broker can also help you navigate the mortgage application process and provide you with advice on how to improve your credit score and increase your chances of getting approved for a mortgage.

Consider alternative lenders

If you’re unable to qualify for a mortgage with a traditional lender, consider working with an alternative lender. Alternative lenders specialize in providing mortgages to borrowers with bad credit or other unique financial situations.

While alternative lenders may charge higher interest rates and fees, they may be able to offer you a mortgage with more lenient lending criteria. However, it’s important to do your research and compare the terms and fees of different lenders to ensure you’re getting the best deal.

Be prepared to provide documentation

When applying for a mortgage with bad credit, you’ll need to provide documentation of your income, employment, and other financial information. This can include tax returns, pay stubs, bank statements, and other financial documents.

Be prepared to provide this documentation to the lender or mortgage broker. Providing accurate and complete information can help increase your chances of getting approved for a mortgage.

In conclusion, obtaining a mortgage with bad credit in Saskatoon can be challenging, but it’s not impossible. By understanding your credit score, working with a mortgage broker, and considering alternative lenders, you can increase your chances of getting approved for a mortgage. Contact me today to learn more about how I can help you obtain a mortgage with bad credit.